Sanctions against Russia have been widely expanded since February 2022. Part of the sanctions involve an export ban by several Western countries on strategic goods.

Summary

- Sanctions against Russia have been widely expanded since February 2022. Part of the sanctions involve an export ban by several Western countries on strategic goods – particularly ‘dual-use’ goods that have commercial applications but can also be used for military purposes.

- The export of dual-use goods by Western countries to Russia has dropped sharply since the export restrictions were tightened. However, Russia still receives billions of dollars’ worth of dual-use goods from third countries, including China, Hong Kong, Turkey and countries in Central Asia.

- Many of the dual-use goods that reach Russia through third countries still stem from companies headquartered in Western countries. This shows that there is still room for improvement in sanction compliance. We outline several options to improve this.

Since March 2014, Western countries have progressively imposed sanctions against Russia. Initially, sanctions were in response to the illegal annexation of Crimea and the destabilisation of Ukraine. After February 24 2022, in response to the large-scale invasion of Ukraine, sanctions against Russia have been widely expanded.

Sanctions taken include financial measures (e.g. Blocking Central Bank’s reserves and decoupling certain banks from the SWIFT messaging system), commerce-related measures (arms embargo, prohibitions on exports and imports of certain goods), energy-related measures and sanctions against individuals and entities with ties to the Russian government or military. The measures are unprecedented in scope as well as size of the targeted economy. The context is also different than during the Cold War, as Russia just before the large-scale invasion of Ukraine was well integrated into the global economy. It had access to and used modern Western technology.

While sanctions apply to an extensive list of goods, certain goods are of particular importance due to their use in weapon systems. The EU, along with Japan, the United Kingdom and the United States, have developed a Common High Priority List, which includes 50 items that are considered most crucial for Russia’s war against Ukraine. These are prohibited dual-use and advanced technology products that have extensive commercial applications but have also been found in Russian missiles and drones on the battlefield in Ukraine. The items on the High Priority List are often referred to as ‘battlefield goods’.

The list is categorised into four tiers, with tiers one and two including the most sensitive goods, such as integrated circuits and other electronic components that were found in Russian military systems (box 1). The list is updated periodically as new information becomes available. The last update was in February 2024, when Computer Numerical Control (CNC) machine tools were added to the list (tier 4b). Products on the list are subject to an export embargo to Russia. However, as only certain Western countries have adopted the Common High Priority List, and many countries remain that have not adopted sanctions against Russia at all, there are concerns that Russia is circumventing sanctions by importing sanctioned goods from third countries.

| box 1: common high priority list |

|---|

Tier 1: Integrated circuits (also referred to as microelectronics) Tier 2: Electronics components including communications modules and passive electronic components Tier 3A: Further electronic components used in Russian weapons systems, with a broader range of suppliers Tier 3B: Mechanical and other components utilised in Russian weapons systems Tier 4A: Manufacturing, production and quality testing equipment of electric components, circuit boards and modules Tier 4B: Computer Numerically Controlled (CNC) machine tools and components Source: UK Gov |

In this research note, we want to address the question: are sanctions on the exports of dual-use goods to Russia effective? Our study builds on an earlier study by Bilousova et al. (2024), which also attempted to map Russian imports of dual-use goods. Bilousova et al. use a transaction-level dataset of Russian imports and covers the period January-October 2023, allowing them to make a detailed analysis of the supply chain of these goods, including jurisdictions through which physical shipments are routed. In contrast, we use the UN Comtrade database, which allows us to collect information for product groupings for the months up to and including December 2023 but does not have information on the transaction-level.

Data used

UN Comtrade is a database with bilateral trade data, available on an annual or monthly basis for 193 countries. We use this database because it contains data on a detailed level of product groups: up to the six-digit level (HS codes). To identify products or product groups on which Western countries have introduced sanctions, we match UN Comtrade product codes with the 50 items that are on the High Priority List.

The UN Comtrade database relies on official sources to ensure the accuracy and reliability of its data. In most countries this is a single agency, like a customs department, a national statistics office, or a relevant ministry. UN Comtrade works directly with these official bodies to collect the data. Following the imposition of sanctions, Russia suspended publication of trade statistics and other key economic indicators. Thus our analysis is based on the data reported by exporting countries, including the EU, US and what we consider to be the main ‘third countries’. We look at the most important third countries: China, Hong Kong, Turkey and various countries in Central Asia. Together, these countries and regions cover 96% of the remaining exports of dual-use items to Russia. The Central Asian economies included here are Armenia, Georgia, Kazakhstan, Kyrgyzstan and Uzbekistan. Tajikistan is excluded due to lack of data.

The UN Comtrade database is subject to data revisions, such as adjustments made to customs declarations or new estimation methods. For example, some countries even allow revisions to data for up to five years back, which means users might see updates to data from previous years alongside the current year's information. Data for some countries also comes in with a significant lag. For example, there is only data available for China up to December 2023. Due to both the data revisions and lags in the UN Comtrade database, we collected data up to December 2023.

Scope of research

UN Comtrade data is expressed in values, which is not the same as trade volume. This matters in this context because there are indications that Russia is forced to pay significant markups for sanctioned goods acquired through third countries. Bilousova et al (2024) found that Russian import prices of critical inputs produced by two major American producers of semiconductors and integrated circuits – Analog Devices and Texas Instruments – have increased by 2.2 times for Analog Devices and 2.6 times for Texas Instruments (2023 compared to 2021). Hence, export values are to some extent inflated by price markups. This means that if there is a decrease in export value, the decline in export volume will be even more pronounced.

The data used do not capture two potential methods of sanctions circumvention. First, product misspecification, meaning that sanctioned goods are reclassified to an adjacent (non-sanctioned) product category. There is some evidence that this is happening, but it is not very strong.

Second, trade that is ‘lost in transit’. This happens if sanctioned goods are on paper exported to, for example, Central Asia, but never reach the destination countries, having been ‘lost’ in transit through Russia. The size of ‘lost in transit’ trade can be gauged by looking at differences in export and import records. Differences between these two regularly occur for various reasons, but a changing ratio in imports reported by the recipient country to exports reported by the sending country could be an indication that trade is deliberately held in the transit country (Russia in this case). If the ratio of imports to exports declines, that would be an indication of trade lost in transit. There is some evidence of trade lost in transit in relation to Kyrgyzstan (Central Asia), but not for the other countries and regions.

The bigger picture

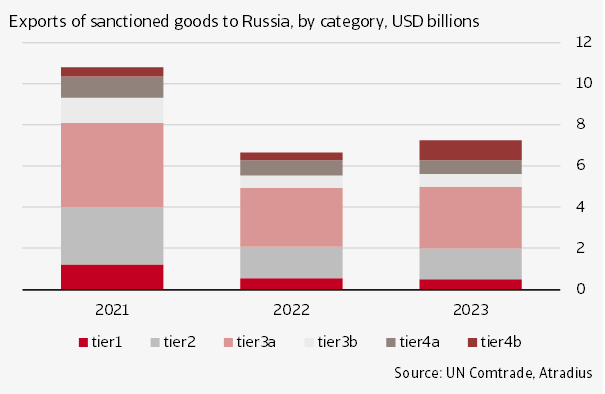

Billions of dollars’ worth of sanctioned dual-use goods still reached Russia in 2023. To be specific, a total of USD 7.2 billion of goods on the High Priority List were exported to Russia in 2023, compared with USD 10.8 billion in 2021. As figure 1 shows, the exports of battlefield goods initially dropped after the start of the full-scale invasion, but it picked up again in the course of 2022. On a monthly basis, around USD 604 million in battlefield goods were exported to Russia in 2023, and the trend towards the end of the year was not downward, but upward.

Figure 1 Exports of dual-use goods to Russia shows some recovery after it dipped in 2022

Tier 3a goods (further electronic components) were the most exported category in 2023: 42% of the total. Tier 3a is a broad category consisting of 16 HS codes, including electrical transformers; television cameras; digital cameras; coaxial connectors; transistors and photosensitive semiconductor devices.

Another 20% of the total are tier 2 goods (electronics components). These include machines for the reception, conversion, and transmission or regeneration of voice, images or other data; radar apparatus; and tantalum capacitors (a component of electronic circuits). The third category (13% of the total) are tier 4b goods (CNC machine tools and components). These are machines that, for example, can transform a piece of metal into a specified shape through the use of preprogrammed computer software.

The most sensitive category, tier 1 goods (integrated circuits, or semiconductors), are 7% of the total.

Figure 2 Electronic components make up the largest part of exported dual-use goods

Shifting trade patterns

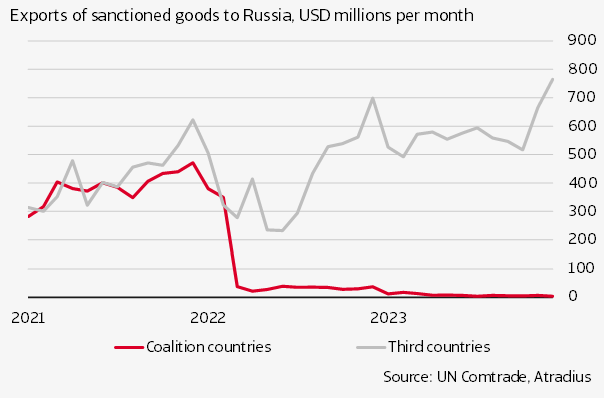

Behind the aggregate export figures presented in the previous paragraph lies a fundamental realignment of trade pattens. Exports from Western coalition countries has dropped sharply after February 2022, the start of the full-scale invasion, while that from third countries has increased (figure 3).

In 2021, the coalition countries exported a total of USD 4.6 billion in dual-use goods to Russia. The exported value is measured according to the country from where the goods were dispatched from, not necessarily where they were manufactured or where the components were manufactured. The EU was by far the single biggest exporter, with an exported value of USD 4.2 billion in 2021. In 2023, the combined export value of dual-use goods from the coalition countries was down to 101 million; a percentage drop of 98%.

Figure 3 Exports from coalition countries has dropped sharply since the start of the full-scale invasion in February 2022

Table 1 Exports of dual-use goods from Western coalition countries to China and Hong Kong, and from China and Hong Kong to Russia, millions USD

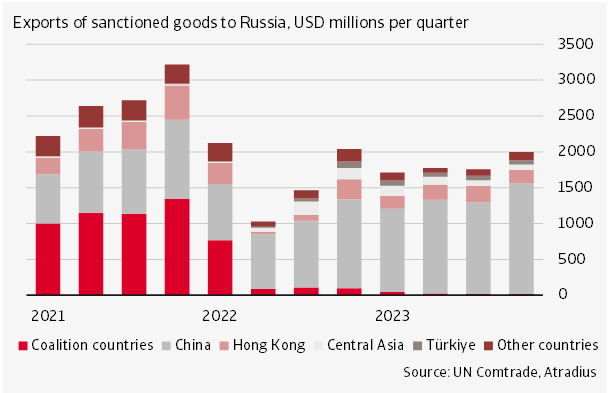

In contrast, exports of dual-use goods from third countries to Russia have increased. These are countries that have not implemented any sanctions against Russia themselves, though in some cases they have said to comply with EU and US sanctions. The exports of dual-use goods from third countries (China, Hong Kong, Turkey and selected countries in Central Asia) to Russia increased from USD 5.1 billion in 2021 to 6.9 billion in 2023; a percentage increase of 36%.

Figure 4 China has become Russia's main supplier of sanctioned dual-use goods

China

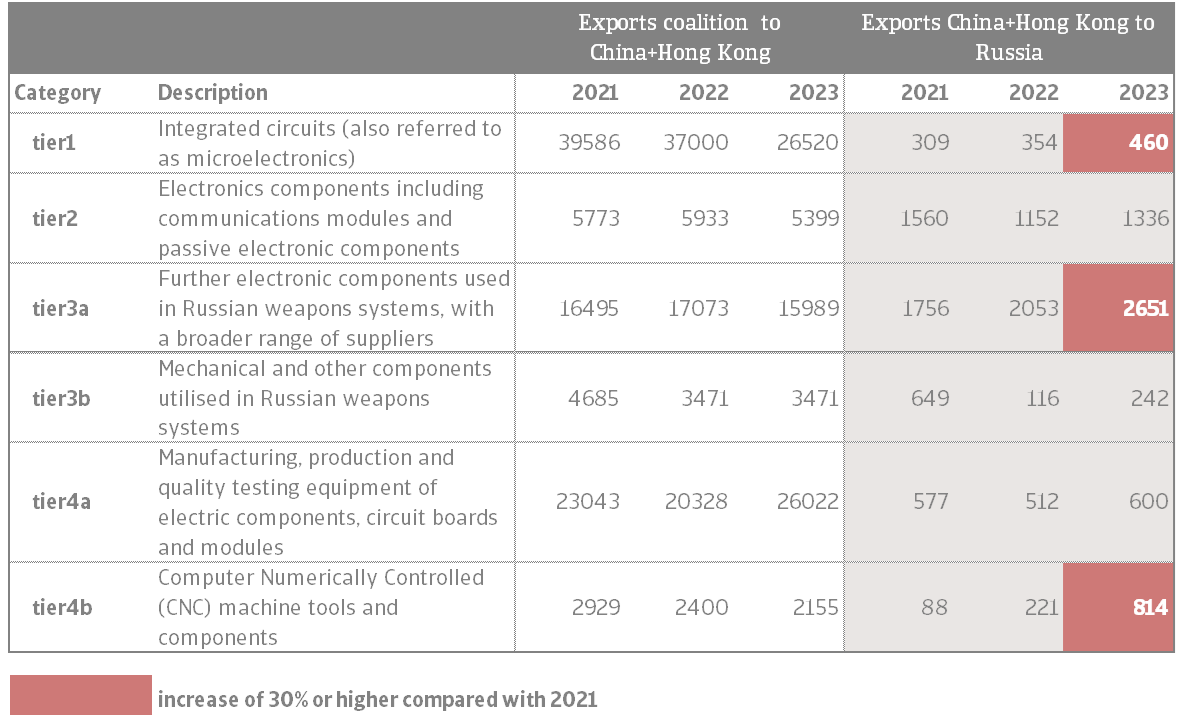

China - which we combine here with Hong Kong for practical reasons - is by far the biggest exporter of sanctioned dual-use goods to Russia. Exports rose from USD 4.9 billion in 2021 to USD 6.1 billion in 2023, according to data reported by the official statistics office to UN Comtrade. 84% of critical components that reached Russia in 2023, were shipped from either China or Hong Kong.

The increase in exports of battlefield goods from China to Russia can be seen in every category, except for goods in tier 2 (electronic components) and tier 3b (mechanical and other components utilised in Russia’s weapons systems) (table 1).

Three categories stand out: tier 1 (integrated circuits, or semiconductors), tier 3a (other electronic components) and tier 4b (CNC machine tools and components). The increase in integrated circuits exports is particularly worrying, as these goods are crucial in the production of advanced Russian precision-guided weapons systems.

Exports of sanctioned products by Western coalition partners to China and Hong Kong decreased between 2021 and 2023, from USD 93 billion to USD 80 billion. But there are large differences between coalition countries, as exports from the US declined by 38%, while exports from the EU and the UK have increased by 9% and 32% respectively. The US in past years has been increasingly cracking down on the export of high tech products, such as microchips, to China, which is visible in these trade figures.

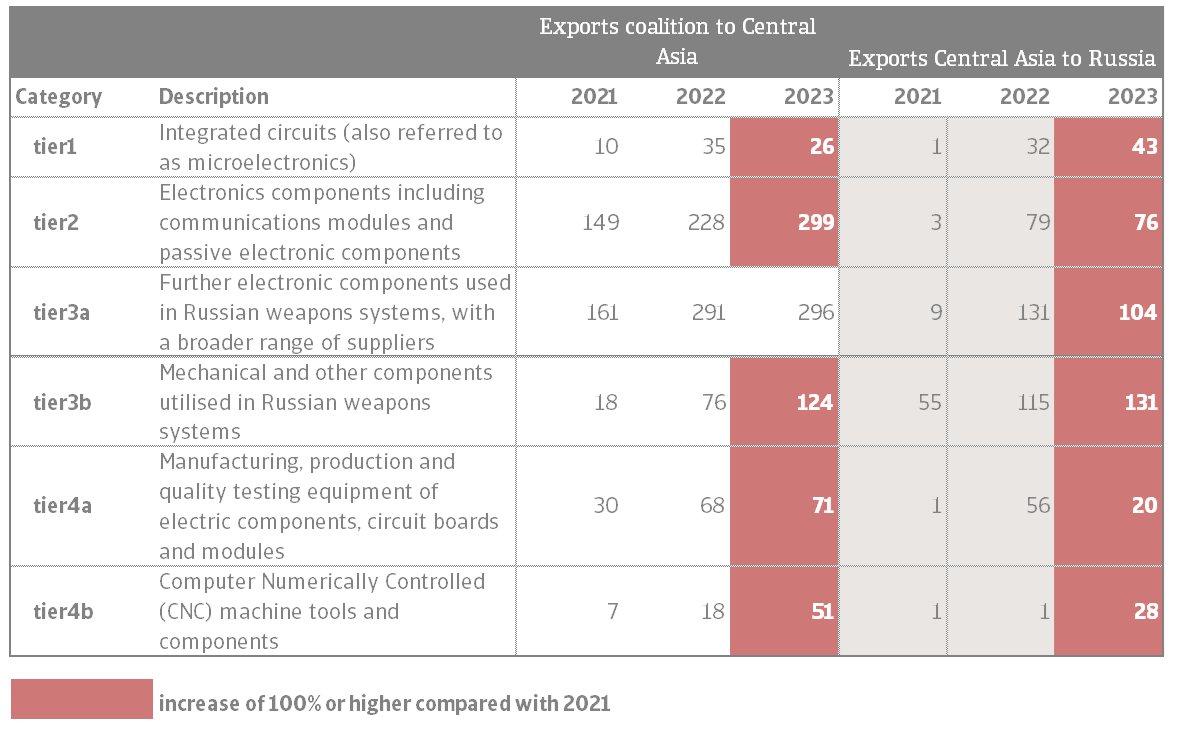

Table 2 Exports of dual-use goods from Western coalition countries to Central Asia, and from Central Asia to Russia, millions USD

For most product categories there was a decline in exports to China and Hong Kong. The exports of tier 1 products (integrated circuits, or semiconductors) declined by 33% between 2021 and 2023, followed by declines of 26% for tier 3b (mechanical and other components) and tier 4b products (CNC machine tools and components).

Only products of category 4a increased, by 13%. Given the size of the Chinese economy and the high value of exports to China, it is more difficult to prove sanctions circumvention. The total value of imported dual-use goods by China in 2023 represents around 2% of what it has exported to Russia in the same year.

Central Asia

There is convincing evidence that Central Asia has been playing a role in sanctions circumvention. This is underlined by the steep rise in exports from this region to Russia. Exports of dual-use goods from Central Asia to Russia has increased from USD 69 million in 2021 to USD 402 million in 2023. For many countries in the region, the percentage increase was significant. Exports from Kyrgyzstan to Russia increased by 2000% between 2021 and 2023, that of Armenia by 1600%, 430% for Uzbekistan and 380% for Kazakhstan.

We see an increase of exports to Russia across all sanctioned product categories. For example, the export of integrated circuits from this region to Russia went up from less than USD 1 million in 2021 to USD 43 million in 2023 (table 2). The data give clear indications of sanctions circumvention, albeit it on a limited scale when compared to China. However, there have been some recent successes. The export of sanctioned goods from Central Asia to Russia did decline materially through 2023, in line with EU and US efforts to crack down on sanctions evading schemes. This is not visible in the table, but it can be seen in monthly export figures.

Central Asia is importing much more sanctioned products from coalition partners compared to before the invasion. The exports of battlefield goods by Western coalition partners to Central Asia more than doubled, from USD 376 million in 2021 to USD 867 million in 2023. The great majority of goods (USD 740 million in 2023) were exported from Europe. In the second half of 2023 we see a decline in the monthly exports of sanctioned goods from Europe to Central Asia. But the level remains significantly above the pre-invasion level.

Contrary to China, Central Asia has more the characteristic of a transit hub for dual-use goods. Around 10% of dual-use goods imported by Central Asia is re-exported in the same year to Russia. In 2022, this was even 17%. These are global imports, so not only from Western countries that have imposed sanctions.

Turkey

Exports of dual-use goods from Turkey to Russia went up from USD 35 million in 2021 to USD 253 million in 2023, an increase of 630%. Exports to Russia increased across all categories. Turkey is also importing more battlefield goods from coalition countries. Between 2021 and 2023, imports of these goods have grown from USD 3.3 billion to USD 5.2 billion. Dual-use goods received by Russia from Turkey represents around 3% of what Turkey has imported from other countries around the world.

Tackling sanctions evasion

The EU and its Western allies have started to crack down on parallel import and sanctions-evading schemes. Two Uzbekistan-based firms and one firm from Armenia were put on the EU sanctions list in June 2023, after having been previously sanctioned by the US. In the same month, as part of the 11th sanctions package, the EU also launched an anti-circumvention tool. The anti-circumvention tool can impose restrictions on companies that have been found to violate EU sanctions and can even be used to restrict the exports of sanctioned goods and technology to third countries altogether. While the tool is seen as a measure of last resort, the threat of its use may be sufficient to persuade third countries to better comply with export controls.

The EU’s 12th sanctions package – launched in December 2023 – introduced an obligation for exporters to contractually prohibit the re-export of certain categories of sensitive goods to Russia, including the goods on the Common High Priority list. The 14th sanctions package of June 2024 contains a ‘best efforts obligation’ concerning foreign subsidiaries: EU companies will have to undertake their best efforts to ensure that their subsidiaries in third countries do not take part in any activities undermining EU sanctions. The 14th sanctions package also includes a ‘No Russia’ clause for Intellectual Property Rights (IPR) transfers, to ensure that industrial know-how transferred outside the EU is not used to manufacture dual-use goods intended for Russia.

The United States has their own experience with export controls. A noteworthy aspect of the export controls regime with regard to Russia is that the entire country is now subject to the US Foreign Direct Product Rule (FDPR). Under this rule, dual-use goods produced outside of the United States but incorporating US components, intellectual property, or software fall under the same restrictions as goods produced within the US. This is an example of sanctions with extraterritorial application, also called secondary sanctions.

When imposing secondary sanctions, US authorities make continued access to the US market and financial system conditional on compliance with US sanctions, which, in many cases, does not leave businesses with any real choice but to comply. For example, European companies were forced to abandon business ties with Iran after America’s departure from the Iran nuclear deal in 2018 despite the fact that their own governments were still party to the agreement. Similarly, after US congress imposed sanctions on the Nord Stream 2 project, European companies were forced to end their involvement in the construction of the pipeline.

Options to tighten sanctions

Sanctions have achieved partial success, as the total global export of dual-use goods to Russia has decreased and Russia has been forced to pay price markups for the goods that it obtains via third countries. Nevertheless, billions of dollars in critical battlefield goods still find their way to Russia and many of these still include Western technology. A significant part of these goods stems from companies headquartered in sanctioning countries. This means that Russia is either not able to replace Western components in weapons or it is not forced to do so, because access to these products remains in place despite the sanctions.

Enforcement of the sanctions regime needs to be stepped up for it to have full effect. The challenges are multifaceted and often not easy to tackle. There are still inconsistencies in the implementation of export controls, even among coalition countries. The publications of the joint High Priority List by the EU, Japan, the UK and the US, is one attempt to harmonize export controls across jurisdictions. But further steps could still be taken. Another challenge is to strengthen government institutions’ capacity to enforce the sanctions. Agencies that are supposed to enforce export controls are often understaffed and underfunded. More resources, but especially a better employment of advanced technology, could help these agencies to detect suspicious transactions and track goods throughout the supply chain. But it will never be a perfect solution, given the size of the target economy and the number of transactions involved.

Two policy areas appear particularly promising when it comes to improved sanctions compliance: more involvement of the private sector and measures directed at third countries that are engaged in sanctions circumvention schemes.

First, it is difficult for sellers of sensitive goods to monitor supply chains downstream once the initial sale has taken place. Non-financial companies could learn from financial institutions, which have developed effective compliance structures in recent years, incorporating processes like ‘know your client’ and understanding their clients’ clients. If non-financial companies could leverage on this experience, that would make export control regimes much more effective.

Second, the third countries that have not aligned themselves with the sanctions, could be more effectively targeted. The EU’s anti-circumvention tool is an example of a mechanism through which exports to third countries can be restricted. Extraterritorial sanctions, or secondary sanctions, could also be used to discipline third countries. While the EU is against secondary sanctions and considers it to be in violation of international law, its anti-circumvention tool essentially aims to achieve a similar goal. The EU does see this as a measure of last resort, to be used only if diplomatic pressure fails. The coming years will have to show whether the EU can more effectively target sanctions circumvention.

Theo Smid, Senior Economist

theo.smid@atradius.com

+31 20 553 2169

Related documents

201.0KB PDF